Introducing the CMS Credit Suite – a web-based suite of credit management tools, complete with commercial credit scoring, financial statement analysis, credit limit modeling, collection monitoring and management, and robust database reporting, delivered from an efficient user-created dashboard.

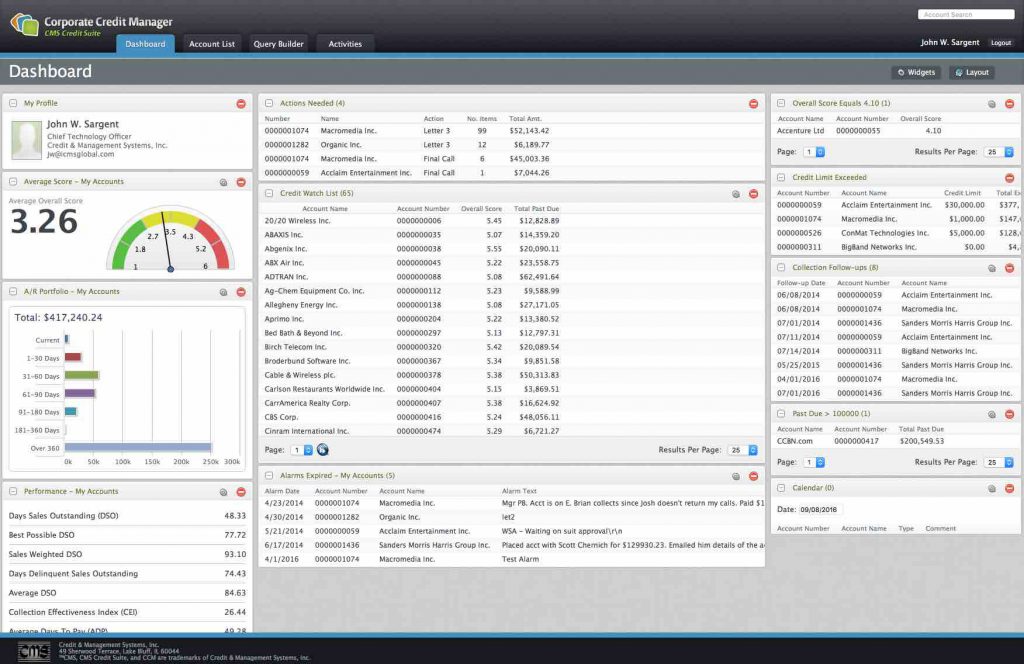

Dashboard

Each user’s dashboard provides an at-a glance view of key performance indicators, alerts, work flows and other data relative to that user’s account portfolio. Continuously updated, the dashboard drives needed actions to the user immediately based upon account prioritization rules. A single click from the dashboard opens an account for information access, updates, and actions as needed.